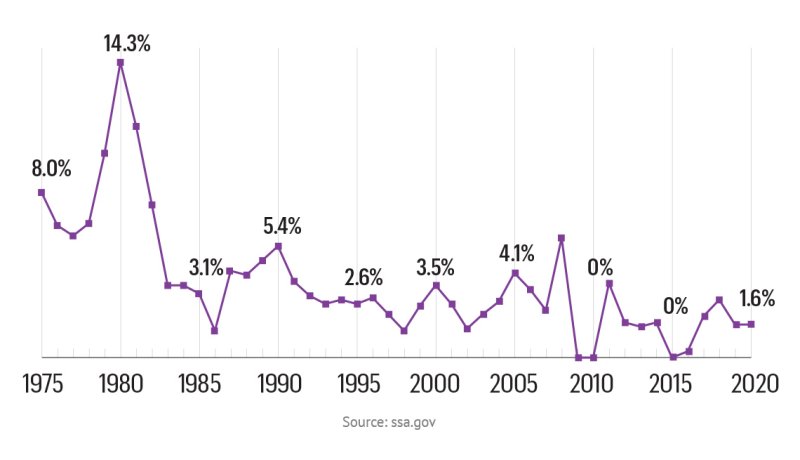

The Social Safety Administration on Wednesday mentioned this system’s virtually 70 million recipients will obtain a cost-of-living adjustment of 5.9% in 2022, the largest improve since 1982.

The advantages bump is available in January after a 12 months of surging inflation, which has pushed up the price of the whole lot from meals to hire. Many seniors and others who depend on Social Safety have struggled to deal with rising inflation this 12 months after receiving a mere 1.3% cost-of-living adjustment (COLA) final January, representing one of the vital meager will increase in latest historical past.

The Social Safety Administration sometimes broadcasts its COLA within the fall, with the rise going into impact for December advantages which can be paid in January. Which means beneficiaries will obtain a large annual “increase” in January 2022, however advocates are involved that seniors’ monetary ache might not abate if inflation continues to flare — which many economists anticipate to be the case, a minimum of for the following a number of months.

“There are a rising quantity of estimates I am seeing that inflation goes to proceed into subsequent 12 months,” mentioned Mary Johnson, Social Safety and Medicare coverage analyst on the Senior Residents League, an advocacy group. “I might not foresee that an virtually 6% COLA goes to revive shopping for energy if inflation continues into 2022.”

Inflation accelerated in September, with client costs rising 5.4% from the year-ago interval, barely quicker than their 5.3% improve the earlier month, the federal government mentioned on Wednesday. Core inflation — which strips out risky meals and power prices — grew 4.0%, the identical spike as in August.

“Grim tales”

Inflation is inflicting some arduous selections for seniors, Johnson mentioned, noting that she has about 200 letters from Social Safety recipients who’re experiencing some type of hardship.

“I’ve nothing however these grim tales,” she added. “Meals is likely one of the No. 1 points we’re seeing. As soon as they pay their hire and electrical energy they do not have the funds for to purchase their groceries or their prescribed drugs.”

About 4 in 10 seniors depend on Social Safety funds as their sole supply of retirement revenue, in line with the Nationwide Institute on Retirement Safety. The everyday month-to-month profit stands at about $1,262 in 2021 — an quantity that’s simply above the poverty line for a single individual. A 5.9% COLA improve provides about $75 a month to that profit.

Social Safety funds had misplaced shopping for energy even previous to this 12 months’s increased inflation, the Senior Residents League estimated in an evaluation revealed earlier this month. Since 2000, authorities retirement advantages have misplaced 32% of their shopping for energy, the group discovered.

The issue, in line with their evaluation, is that the Social Safety Administration depends on an index referred to as the Shopper Value Index for City Wage Earners and Clerical Employees to set the annual improve for retirement advantages. That index would not embody value will increase in Medicare premiums and it underweights the housing prices which can be often skilled by seniors, as an example.

“The index that’s getting used is for youthful wage earners,” Johnson famous. “It would not account for the shopping for patterns of older adults,” resembling increased spending on healthcare.